Secure your future

A Step-by-Step Guide to Making Your Will

Secure peace of mind for yourself and your loved ones by writing your Will with confidence.The Basics

Why do you need a Will?

A Will kicks in once you’re gone. Your Will is like a parting gift to your loved ones, making things

a little easier for them when you’re gone by:

- simplify the (often voluminous) paperwork,

- reducing the stress and confusion,

- providing clear instructions on your wishes.

Plus, with a legally enforceable document, you can rest easy knowing your wishes will be respected.

Here’s the real kicker: without a Will, it’s the law at the time of your death which will decide what happens to your assets and who gets to make the decisions. It’s safe to say that most people we’ve spoken to don’t like this option much – and we don’t either!

So, whether you’re a pauper or a millionaire, a Will makes a world of difference for your loved ones by making a tough time a little more bearable

What else can I deal with in my Will?

Funeral arrangements.

Your Will can also address your funeral arrangements. You can specify whether you would like a funeral service and if so, what type of ceremony or religious process you prefer. Additionally, you can express your wishes to donate your body to science, and whether you prefer burial or cremation, along with the specific location of your final resting place.

While it’s helpful to have these wishes recorded in your Will, just make sure your next of kin and executor know what these wishes are if they make decisions about your funeral before they read your Will. To ensure that your wishes are carried out, it’s a good idea to fill out an estate planning booklet with all of the information your family will need. If you need help with this, we are here to assist you.

Who are the key persons in a Will?

Executors.

The executor(s) in your Will are the person(s) who have authority and responsibility for looking after your estate. They are the legally recognised figure heads, they make the decisions for the benefit of your beneficiaries and follow the terms of your Will.

You can have up to 4 executors (although less is often better), so you can elect to have a main executor and back-up executors. An executor can be anyone over 18 years of age, they can be a beneficiary, or not.

If you have young kids, consider the age, willingness and ability of your chosen executor before naming them in your Will and make sure they’re happy to take on the responsibility.

Quick tip: ideally, your executor/s should be someone you trust who is good with paperwork.

Beneficiaries.

Beneficiaries are the people who will receive the assets outlined in your Will. You can make specific gifts, such as property or money, or divide your estate in equal or unequal shares among your beneficiaries. It’s also possible to delay gifts until a certain age is reached.

If you have minor beneficiaries under the age of 18, they won’t be able to inherit until they reach adulthood. In this case, your executor (or trustee) would usually be responsible for managing their inheritance until they are of legal age. You’ll also need to decide at what age you’d like your minor beneficiaries to take control of their inheritance.

Quick tip: be mindful of your executor(s) age and willingness to potentially look after a youngster’s inheritance for years into the future

Minor beneficiaries.

These are beneficiaries under 18 years of age – they can’t take charge of their inheritance until they’re an adult under law. A minor beneficiary would usually have their inheritance looked after by the executor (trustee) until they are of age. Another quick tip: be mindful of your executor(s) age and willingness to potentially look after a youngster’s inheritance for years into the future.

One of the decisions you will have to make with minor beneficiaries is what age you would like them to take control of their inheritance

Guardians.

Guardians are the individual(s) appointed under a Will who would take on parental responsibility for your children and make decisions about their care, education, and general welfare if you are not around. You can nominate one or more persons as the main guardians and have back-up guardians in case your primary choice cannot take on this responsibility at the time.

Get Will educated

Are there different types of Wills?

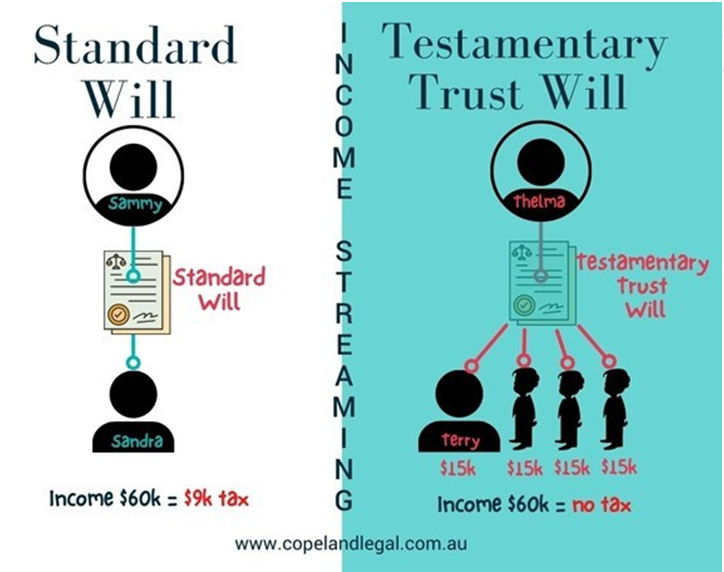

The main types of Wills are standard Wills and Testamentary Trust Wills. Our team can help you determine which type of Will is best for you and ensure your wishes are recorded in a legally enforceable document.

Standard Wills.

Standard Wills get the job done. They appoint executors, make gifts, and distribute assets to beneficiaries, and can even be used to hold an estate in trust until beneficiaries reach a certain age.

When it comes to creating a Will, most people will find that a Standard Will is sufficient to meet their needs as it ensures their wishes are recorded in a legally enforceable document.

If, however, you have assets exceeding approximately $1 million, beneficiaries who may be at risk of bankruptcy, or want to prevent family law issues if their children’s relationships break down, a Testamentary Trust Will may be worth considering.

Testamentary Trust Wills.

Sound fancy? A Testamentary Trust Will is a Will that includes a trust deed that only activates upon passing, and can be used for up to 79 years. Multiple trusts can be created for each loved one, or a single trust can be created for all to share and operate. Testamentary trusts can also allow:

- Streaming income to different family members who can each take advantage of the tax-free

threshold, which can be useful and tax-effective for families with children, grandchildren, or

an extended family you want to benefit. - Structuring wealth management for the family, as trusts can be a good way to hold assets

instead of in an individual beneficiary’s name. - Providing protection against risk, such as the risk of relationship breakdowns, creditors,

bankruptcy, poor financial management, and claims on the estate itself.

I have a Will but I’m not sure if it’s still ok. What do I do?

If you’re unsure about the validity of your Will, have it reviewed by a lawyer. The uncertainty and potential risks of not having a legally enforceable Will are not worth the potential headache you may leave behind for your loved ones.

Additionally, there are certain life events that can revoke a Will, such as:

- The death of someone mentioned in your Will

- The disposal of something intended to be gifted in your Will

- If you have married or divorced

- If you have separated

- If you have started a new de facto relationship

If any of these apply to you, please update your Will. We’re here to help.

Do I need a Will if I have no assets?

Yes. Even if you have no significant assets, it’s still important to have a Will. Imagine if one day, you decided to open the front door and walk away from your life. Bills would need to be paid, bank accounts closed, and your possessions would need to be dealt with – just to name a few. Without a Will, there’s no legally appointed person to handle these matters, and there are no instructions for what to do with any assets you may leave behind.

Does superannuation form part of my estate?

Generally, superannuation does not automatically form part of your estate, as the trustee of your super fund has discretion to decide who receives it if you pass away without a valid death nomination. However, your Will can sometimes play a role in the distribution of your superannuation, particularly if you have made a binding death nomination.

Do I need a large estate to benefit from trusts?

Not necessarily. While a Testamentary Trust Will can provide tax benefits for larger estates, trusts can also be useful for smaller estates. Trusts can assist with caring for a disabled loved one, protecting against poor financial management or unexpected risks, and ensuring that an inheritance is managed and distributed in a way that aligns with your wishes.

Can my beneficiaries inherit debt?

When you pass away, any outstanding debts that you owe may be paid from the assets you leave behind in your estate. This means that your beneficiaries may inherit less than what you had initially intended. If the debts exceed the value of the assets, the estate may be declared insolvent and creditors will receive a portion of what they are owed.

Can I give away my half of the house?

In legal speak: it depends. If you own the property as joint tenants with another person, then you cannot bequeath your half of the house in your Will without changing ownership. However, if you own the property as tenants in common with another person, then you can leave your share of the house to a beneficiary in your Will.

Are Will kits good enough?

A good (lawyer) friend once told us that her view on getting a DIY Will kit versus getting a lawyer to prepare the Will was like the difference between riding a bike with an ice cream bucket versus a bike helmet. If you need it, best decide what you’d rather be wearing.

DIY Will kits may lead to heartache for your loved ones and costly disputes. They may not account for all legal requirements or considerations, risking unintended consequences or invalidation. A lawyer can offer professional legal advice, draft a Will, and guide estate planning strategies. This can save your loved ones significant time, money, and stress in the long run.

Where do I store my Will?

One of the most secure places to store an original Will is in a safe custody, such as a law firm’s safe custody or a bank’s safety deposit box. If you have a home safe, that can also be a suitable option. While there is a central registry for Wills with the NSW Law Society, it’s not commonly used unless there’s a specific reason to do so.

Don’t leave your important legal documents vulnerable to loss, theft, or damage.

At Copeland Estates Legal, we offer free safe custody for all of your important documents, including your Wills, Powers of Attorney, and Enduring Guardianships. Keeping your original documents in a safe place while also having copies or certified copies available is the best way to have your cake and eat it too.

A little on deceased

estates

Does my executor need to use the lawyer who holds my Will to look after my estate?

No. Often if a lawyer holds a Will, they are holding it on behalf of your loved one and must release it to the executor(s) upon receiving their direction to do so. You can choose your own lawyer that you trust to look after your loved one’s deceased estate.

Do executors get paid?

Executors are entitled to be reimbursed for any expenses incurred while administering the estate, but they may not necessarily be paid for their time and effort. If an executor is also a beneficiary of the estate, their inheritance may be considered their compensation for services rendered. However, if they are not a beneficiary, they can seek payment for their services through beneficiary consent or by applying for executor’s commission through the Supreme Court.

Who pays for legal costs in a deceased estate?

The estate itself. All costs and expenses and liabilities will usually get paid by the estate before beneficiaries receive a distribution.

Will my executor need to apply for Probate?

If you have a valid Will and leave assets that require it, such as a house owned in your sole name or as tenants in common, your executor must apply for a Grant of Probate. Take our free quiz here to find out if Probate is necessary for your estate.

Your next steps

If you haven’t already, there are certain questions you can ask yourself or sit down with your significant other over a glass of your fav beverage to discuss your views. This will help you decipher what specific matters you need to make sure you cover off in your Will.

First question: who will you appoint as your executor?

Now consider appointing a back-up executor in case your first choice is unable to act.

Second question: What are your assets and liabilities?

Confirm ownership of your assets (sole name or joint names), how property is owned (solely, joint tenants or tenants-in-law), what your debts are and in whose name they are in including any guarantors (if any), whether you have nominated beneficiaries under life insurance and super. This is not an exhaustive list but it gives you an idea.

Third question: who will be your beneficiaries?

Think about who you want to benefit from your Will and how you want them to benefit.

- Do you have specific gifts you want to make?

- Is there a charity you want to help?

- Do you want your loved ones to receive an equal amount of whatever you own when you

pass away? - Is there an age when you would want them to inherit?

- Who would receive the assets meant for a certain loved one if they were to predecease you?

- Do you want to divide whatever happens to be in your estate at the time equally or in different proportions between certain persons?

Fourth question: If you have children, who will raise them and manage their inheritance?

This is a crucial consideration that provides peace of mind knowing you’ve taken care of your family in case of the unexpected. Think about who will raise your kids if you and your significant other die, who will manage their inheritance until they are of legal age, and at what age they should take control of their inheritance. If you your fur babies and your kids, consider who would care for them and if that person would receive compensation for their care.

Last question: What do you want to happen to your remains when you die?

Consider whether you have a preference as to burial or cremation, whether you want a religious ceremony performed, if you want any funeral at all and whether you want your body donated for research or science.

Now that you have considered the important matters

that you need to cover off in your Will, it’s time to write

down the information you’ve gathered so that you can

begin the process of creating your Will.